Contributions Affect Your Retirement Outcome

Aoife O’Reilly

Why are people waiting to start investing?

We know investing early is key but why do so many people reach their 40s before they start to invest?The answer is priority. When we grow up, we hear from our friends, family, and neighbours the importance of going to a good school and paying off your student debt, buying a home, starting a family, and simply enjoying our life while we are young. Saving for retirement is rarely the main topic of discussion at the kitchen table.

There is also a lack of financial education among the younger generation, which means they’re more hesitant to take risks by investing in the stock market. It is normal to prefer waiting on the sidelines during turbulent times. An excellent way of maximizing wealth, while also managing risk, is to invest in the form of monthly contributions.

Compound interest is the 8th wonder of the world. Here’s why:

Compound interest is defined as the interest earned on your initial investment and on the accumulated interest previously earned. Think of it as the cycle of earning “interest on interest” which can cause wealth to rapidly snowball.

For example, John invests $5,000 on January 1st, 2020, and earns 10% interest on his investment every year.

On January 1st, 2021, John will have $5,500 ($5,000 + $5,000 at 10%) in his investment account earning $500 interest on his initial $5,000 investment.

On January 1st, 2022, John will have $6,050 ($5,500 + $5,500 at 10%) in his investment account earning an additional $500 interest on his initial $5,000 investment and $50 interest on the $500 interest that John had earned in 2021. This additional $50 may seem like a small difference but it will be significant in the long term.

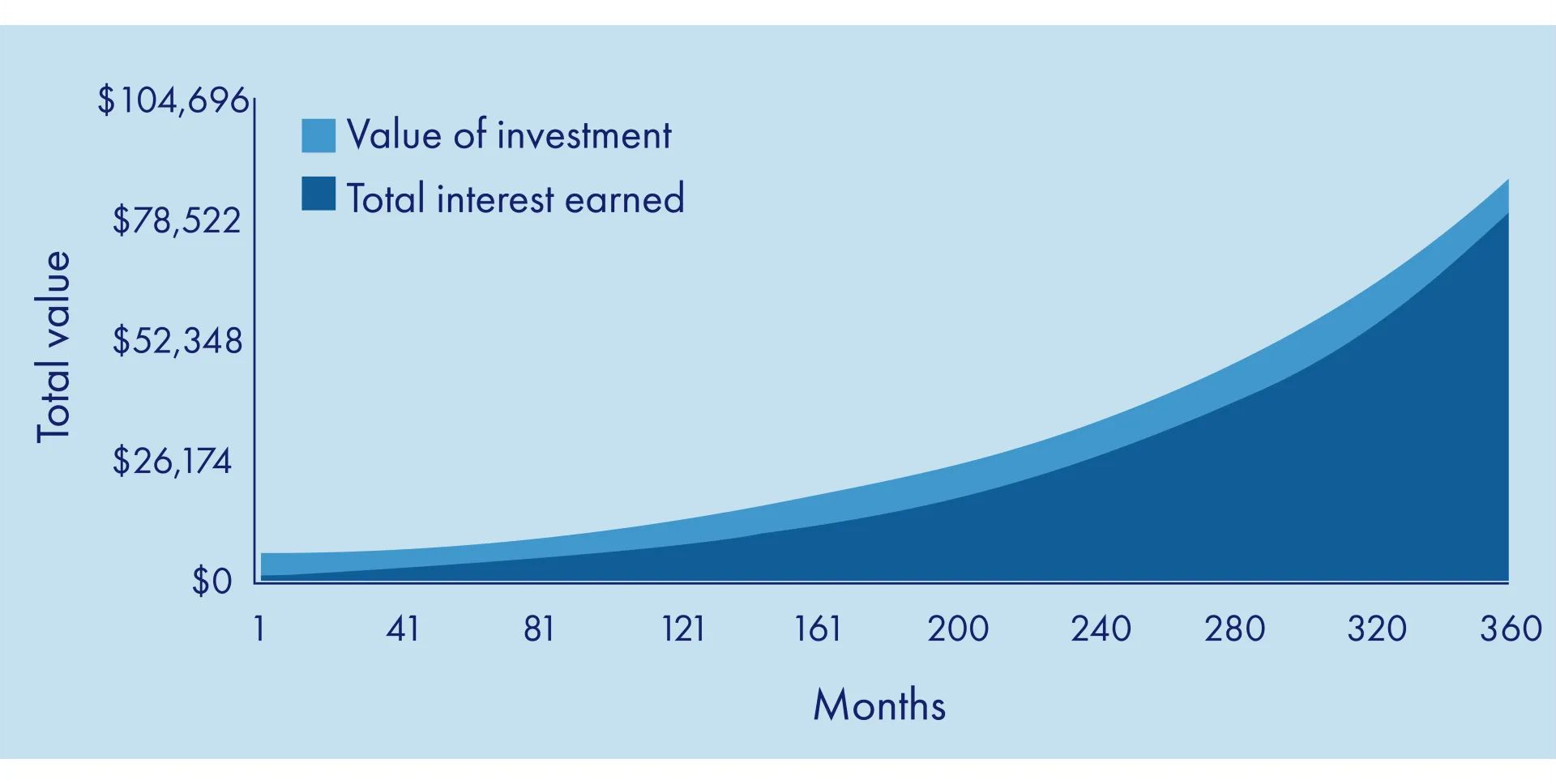

Below is a graph illustrating how compound interest works:

Your initial investment of $5,000.00 at an annualized interest rate of 10% will be worth $87,247.01 after 30 years when compounded yearly.

Why should you start investing early?

You may think you have plenty of time to start saving for retirement. After all, you are in your 20s and have your whole life ahead of you, right? That may be true, but why put off saving for tomorrow when you can start today?

The younger you start, the less you will need to invest monthly to reach the same retirement objective.

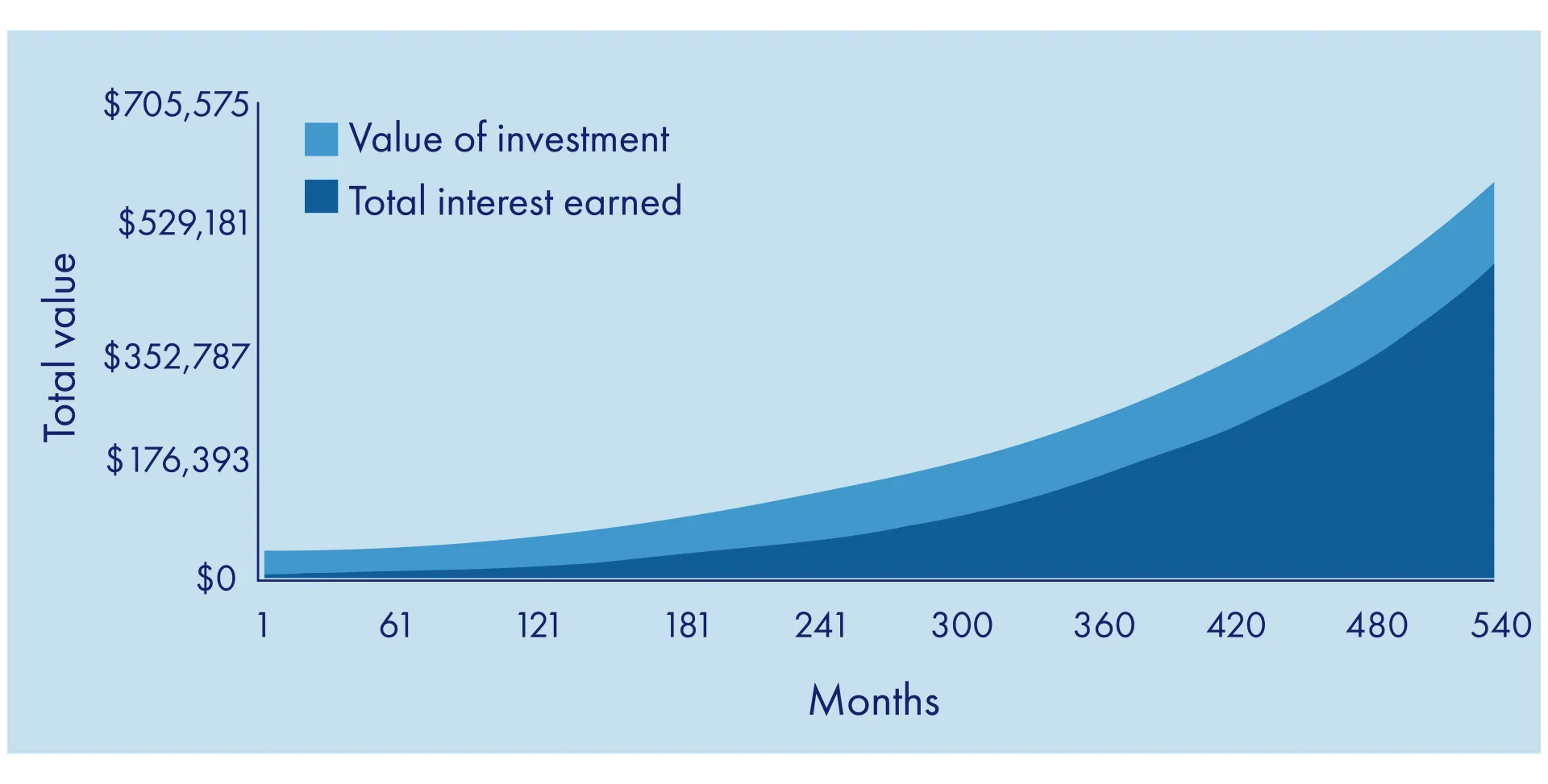

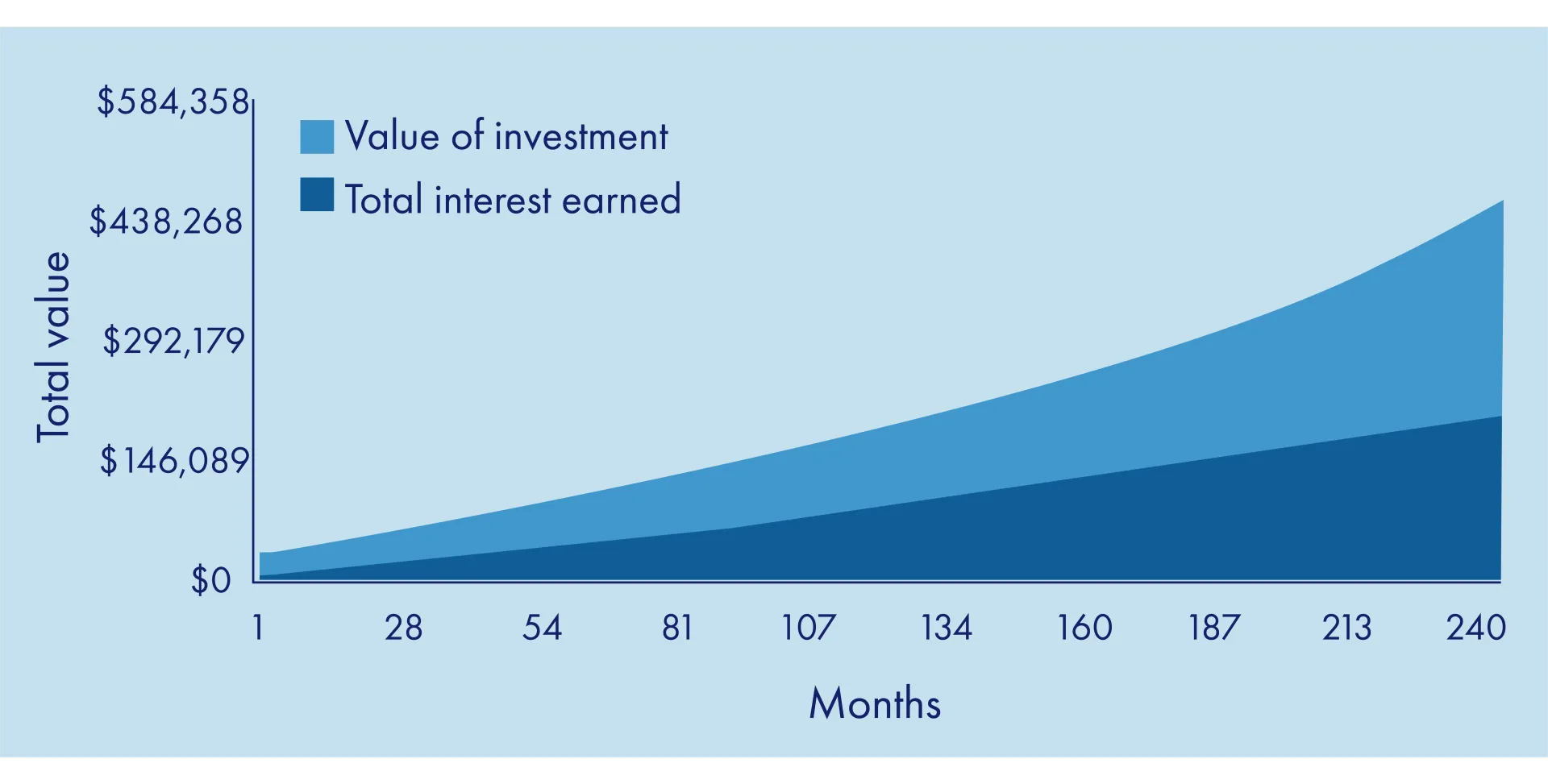

Let’s look at two scenarios where 5% interest, compounded annually, is earned each year.

1. $300 is invested monthly from the age of 20 to the age of 55.

2. $1200 is invested monthly from the age of 45 to the age of 65.

1. The monthly investment of $300.00 at an annualized interest rate of 5% will be worth $587,979.76after 45 years when compounded yearly.

2. The monthly investment of $1,200.00 at an annualized interest rate of 5% will be worth $486,965.38 after 20 years when compounded yearly.

In the first scenario,$587,979.76 is the amount available at retirement after investing $300 per month for 45 years. In the second scenario, even after having invested 4 times as much monthly, there is still significantly less available at retirement ($486,965.38)

Starting early can help you allocate a smaller portion of your disposable income toward your retirement plan and will ultimately provide you with a better retirement outcome.

Riding the Learning Curve

Investing early will allow you to experience the ups and down of the markets at an age where the volatility has little impact on your overall retirement outcome. This will help build confidence and force you to learn valuable lessons on how the market behaves. This will prevent costly mistakes occurring in later years.

It also helps form good financial habits by focusing on budgets and decreasing expenses when required.

Time allows you to take risks

Age often influences the amount of risk we are willing to withstand in the market, which is inevitable if you want your investments to grow.

Younger investors can opt for portfolios with comparatively aggressive investments that can yield higher returns than conservative investments, while older people need to take less risks heading into their retirement years. Younger investors have the time to recover if something were to go wrong, which provides the opportunity to focus on more aggressive portfolios.

You can weather unexpected events

It’s always a good idea to be prepared. You just never know when something will come along to change your financial outlook. From an unexpected career change, health issues to market downturns, life is like a box of chocolates – you never know what to expect.

Putting money aside early can help you handle these little emergencies without having to significantly change your financial plans. Even cautious investors can be affected by market downturns, which is another reason it’s so important to save early. It means that if the markets take a downturn, you have time to make up for it. On the other hand, if a market impacts you while you’re scrambling to save for retirement, it can be a lot harder to recover.

How can you get back on track if you started investing later in life?

As mentioned above, the best way to save for retirement is to start early. If you have less time to save for retirement, you’ll simply need to save more each year or decide to retire later. This will mean making a larger sacrifice to your lifestyle to prioritize your retirement savings.

One of the solutions that is rarely considered when looking at ways to improve your retirement outcome is to consider working part time for the first 10 years of your retirement. This would allow you to require less income from your retirement savings to supplement your employment income and your retirement government benefits. This is also a great way to stay active in your community and prevent the feeling of isolation that many retirees experience.

Working with a certified financial planner to ensure that you are maximizing tax efficiencies could help you gain access to more government benefits and can also lead to greater income after tax.

Conclusion:

Starting early is the easiest and more effective way to ensure you have a worry-free retirement. If that is not possible, there are still many steps you can take to improve your retirement outcome.