Group Retirement Plans

We do group retirement plans differently.

At Open Access, we believe investing in the future is the best way to achieve financial wellness. Our members benefit from smart investment decisions that keep their retirement goals on track.

Our retirement plans contain the winning combination of professional investment management, personalized service and financial education.

Defined Contribution Pension Plan (DCPP)

This pension plan has no pre-determined payout at retirement. Instead, payment is based on the total assets accumulated by the plan member once they retire.

Group Retirement Savings Plan (GRSP)

Like individual RRSPs, GRSPs afford employees more flexibility in their saving habits. Tax-free withdrawals are allowed under the Home Buyers’ Plan & Lifelong Learning Plan.

Deferred Profit Sharing Plan (DPSP)

This plan allows companies to share their profits with employees. A DPSP often substitutes or supplements a GRSP and is a cost-effective alternative to a DCPP.

Defined Benefit Pension Plan (DBPP)

With a DBPP, your employees receive a lifetime of retirement income, calculated on the length of their tenure and the average salary they earned.

Group Tax-Free Savings Account (GTFSA)

This is a popular savings plan that allows your employees to avoid taxes on the income and capital gains they make over time.

Many employers that have approached and engaged with Open Access have suffered from one of the following:

1) Plan design strategies are out of date.

2) Fees are high, poor performance and unsure if competitive.

3) Complex investment menus.

4) No formal education, communication and visibility of the plan.

5) Lack of engagement and participation.

6) No formal review process.

Do any of these issues currently concern you?

If so, contact us for a free no obligation assessment of your group plan.

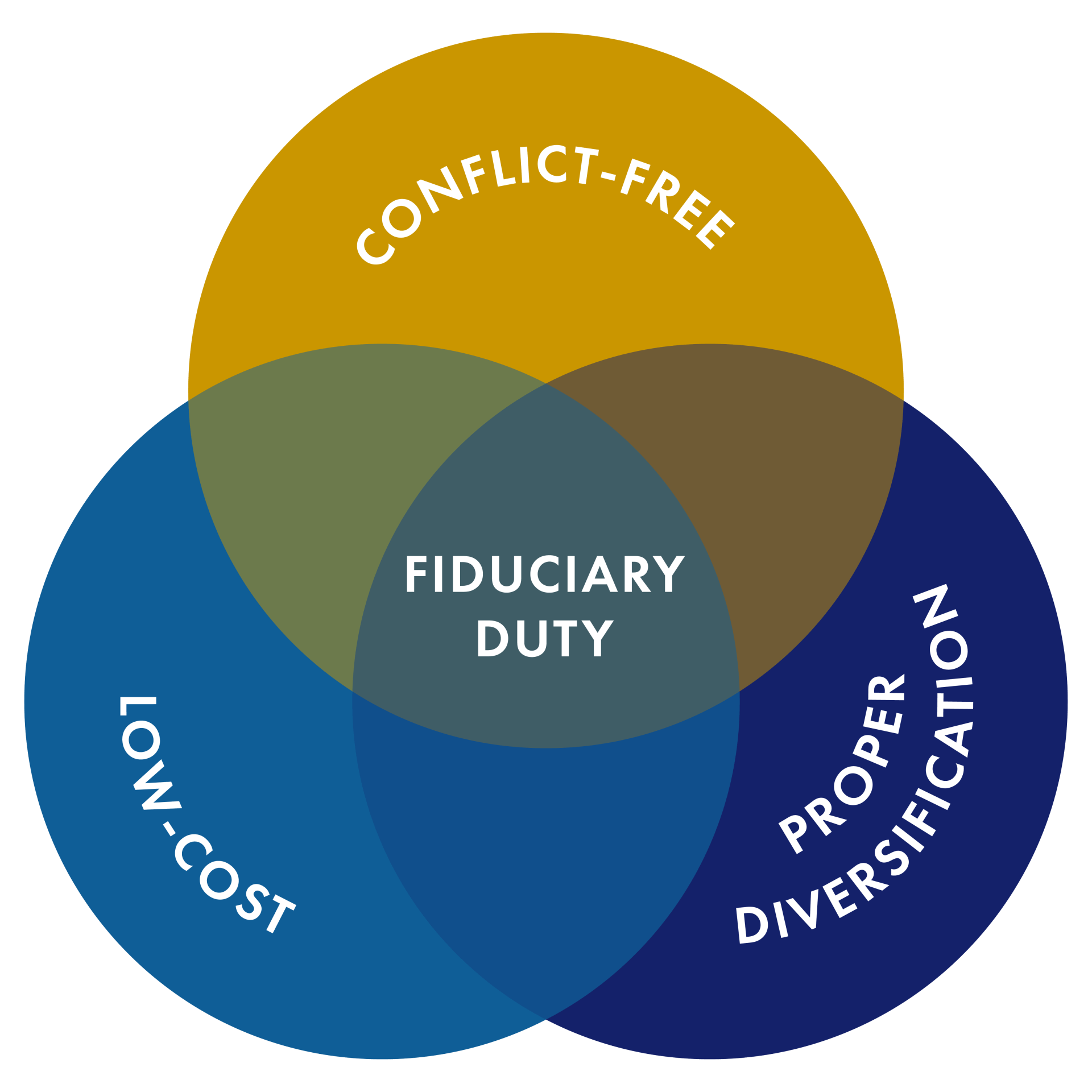

Open Access Ensures all Fiduciary Roles Have Been Fulfilled

Fiduciary Fast Facts

Who is considered a fiduciary?

- Investment or retirement plan committee member.

- Investment manager who manages plan assets.

- Plan sponsor who chooses an investment advisor.

- The chosen investment advisor.

- Anyone who makes decisions about the administration of the plan, including the plan administrator

A holistic approach with an eye towards the future

Reduce Your Fiduciary Risk With Open Access

Decisions solely based on the best interest of participants and providing a better retirement outcome.

Favourable fee arrangements due to economies of scale and seamless manager changes

Professional oversight, monitoring of investments and broad diversification

Delegate the fiduciary liability to the discretionary investment manager

Risk protection for the sponsor and risk mitigation for the participant

Participants are not burdened with making complicated investment decisions

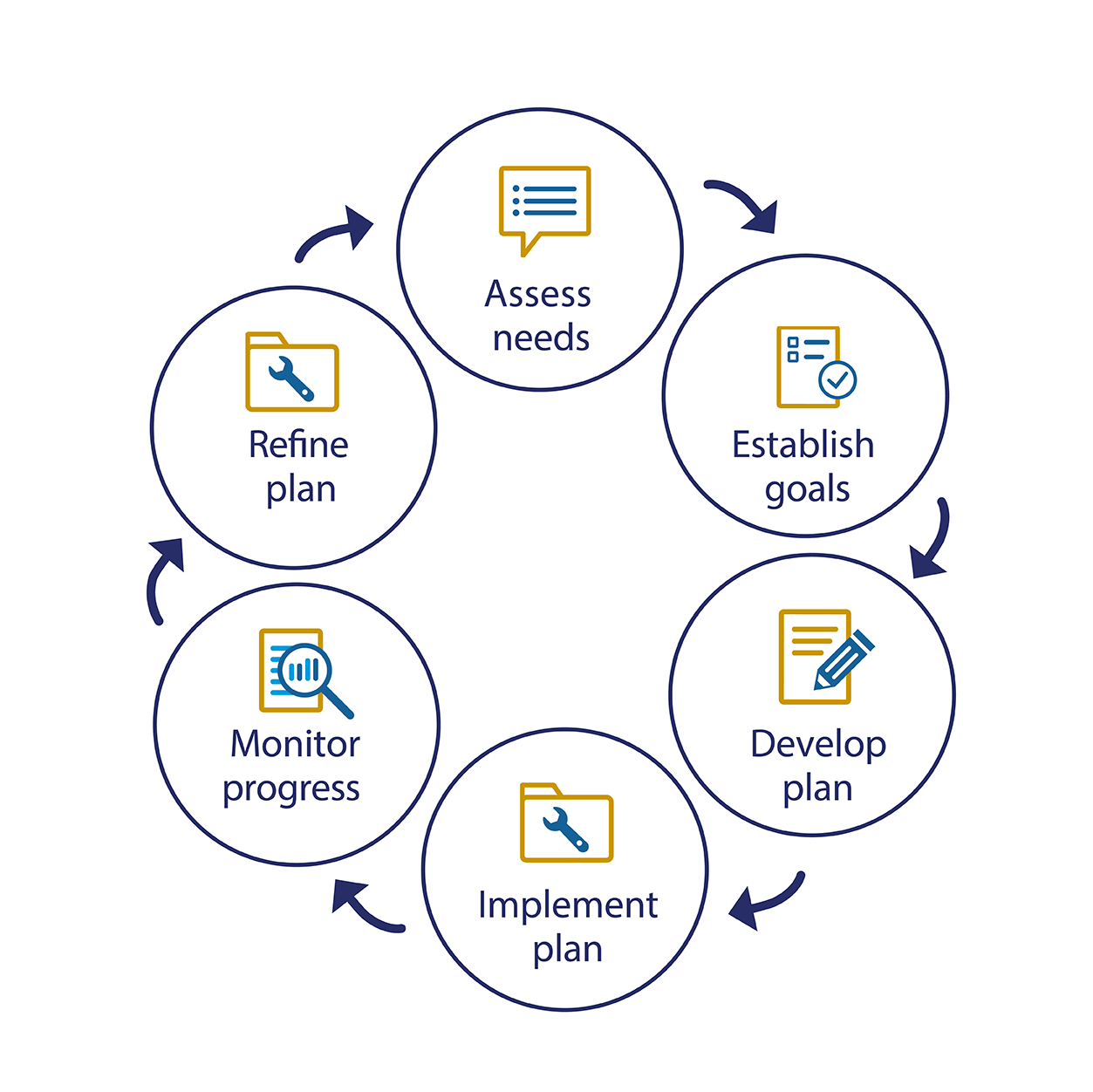

How we optimize your group retirement plan

Step 1

Our team creates a plan with eligibility, matching and withdrawal restrictions of your choice. All of our plans are fully customizable. Our aim is to prioritize the financial goals of your workforce.

Step 2

Onboarding is a seamless experience for you and your team. We offer regular access to support teams and provide interactive one-on-one sessions with dedicated experts.

Step 3

Our educational hub helps your team cultivate financial wellness. We share webinars, fact sheets, videos and presentations to help your team maximize their savings.

Here’s how we compare against traditional retirement plan providers

| Plan Features | Open Access | Traditional Provider |

|---|---|---|

| Zero conflicts of interest | Always | Rarely |

| Discretionary management | Always | Occasionally |

| No proprietary funds | Always | Rarely |

| Fully disclosed fees | Always | Rarely |

| Dedicated Relationship Manager | Always | Occasionally |

We believe that every Canadian deserves to retire well – our retirement plans are designed with exactly that outcome in mind. Learn more about our investment philosophy here.

With Open Access, Canadian fiduciary retirement plan provider by your side, your investments are always protected and safe.