Investments

Invest wisely. Retire well.

Our investment philosophy

100% client-focused

Many financial institutions view group retirement services as just another channel to distribute their own mutual funds. Open Access is different. We specialize in providing unbiased and conflict-free money management.

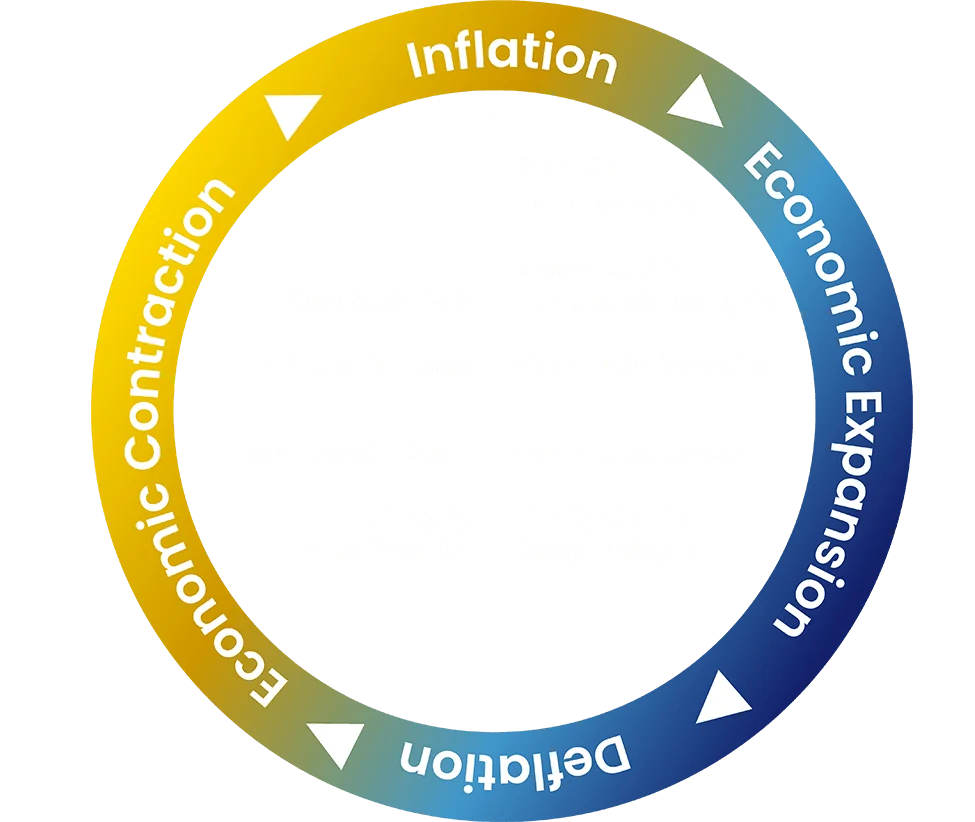

Our client-driven investment philosophy delivers competitive performance, net of fees, over multiple market cycles.

What are our guiding portfolio management principles?

01

Investment success is half as complicated, but twice as difficult, as it seems

Simple strategies lead to powerful long-term results. However, they can be tough to stick with in the short run.

02

Look at active and passive investment strategies

Many people prioritize one over the other – we recommend a healthy mix of both active and passive investment strategies to keep your financial goals on track.

03

Strong risk-adjusted performance is key

High returns in the short-run can be completely undone by volatility. Compounding wealth requires managing both returns and risk.

04

Diversified portfolios beat market timing

Investing and betting are two different strategies. The odds favour the house.

05

Member alignment

High returns in the short-run can be completely undone by volatility. Compounding wealth requires managing both returns and risk.

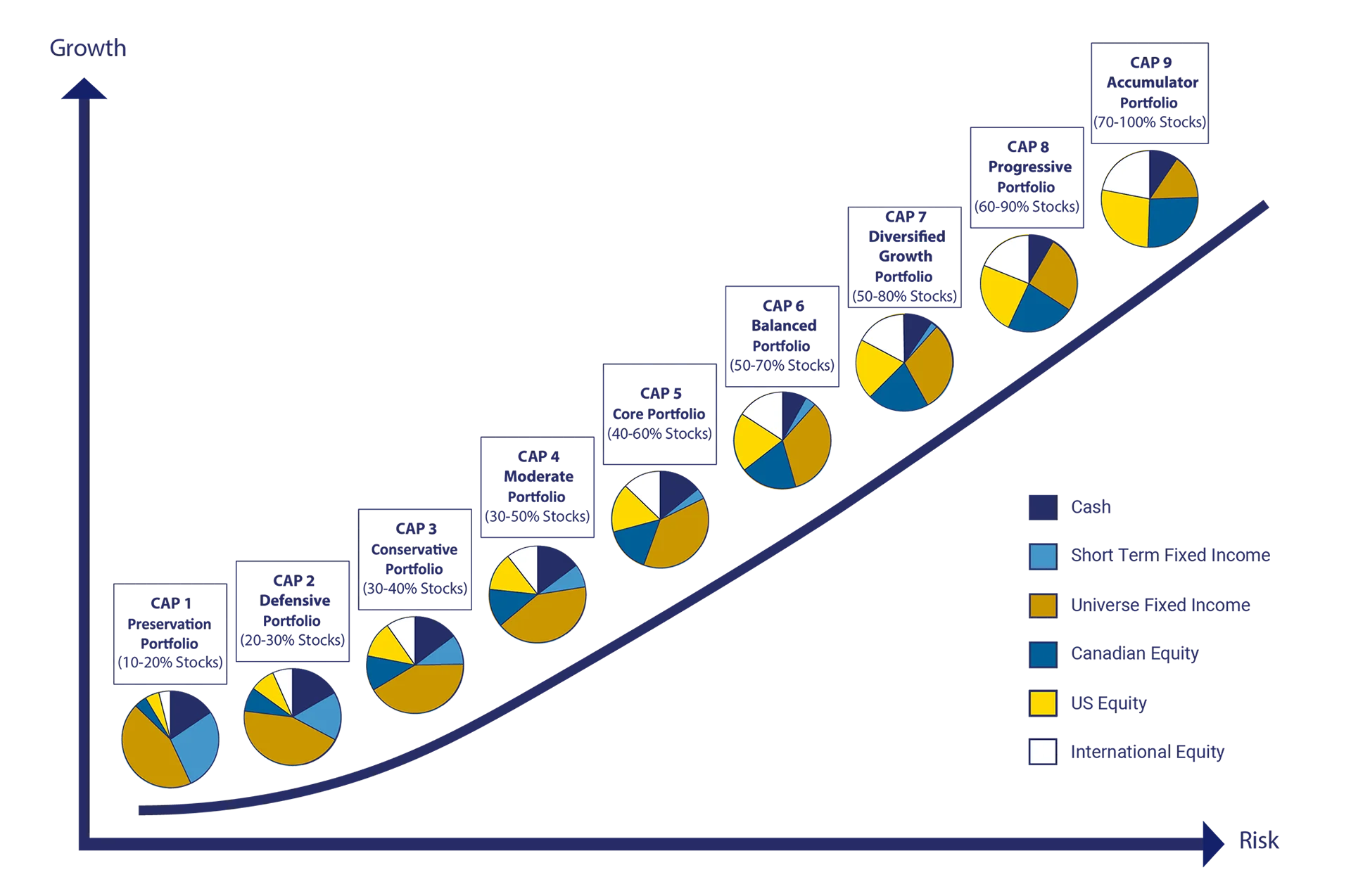

Dynamic asset allocation

Most money managers focus on stock picking, but the secret to investing well is determining how best to allocate savings across a diversified mix of growth and income strategies.

Companies offering diversified portfolios often adopt a ‘buy and hold’, or, in other words, a ‘set it and forget it’ approach. Open Access approaches investments differently. Our investment team actively rebalance the asset mix of every account.

Members know that throughout market cycles, they have a professional team managing their nest egg. The result is true outperformance – performance that accounts for returns as well as strong downside protection.

Active fund selection

Active fund managers or low-cost index funds – which is best? The answer is subjective and largely based on marketing tactics. Companies take a stand either way in order to support their own products.

Open Access has no in-house products to sell which enables us to provide unbiased wealth management advice to our members. Our investment philosophy is simple. Our portfolios incorporate the strategies that best align with our members’ financial goals. By blending active and passive funds together, plan participants get the best of both approaches.

The Open Access investment team works on our members’ behalf to scan the marketplace of investment strategies and select those poised for sustainable performance.

This investment process entails reviewing four key criteria:

Intellectual Capital

The experience, workload and temperament of the fund management team

Opportunity

The soundness of the investment process and philosophy implemented by the fund management team

Execution

Reviewing historical performance and fund positioning consistency relative to the investment process and experience of the team

Alignment

Assessing fees, compensation and firm culture to achieve congruence with our client’s goals

Doing Well by doing Good

All fund managers on the Open Access Investment platform are signatories of the UN Principles for Responsible Investment.

As a result, our clients not only benefit from strong performance, they are also assured that their investments are aligned with promoting best practices in global Environmental, Social and Corporate Governance (ESG) matters.

Latest Insights

Market Commentary – July 2024

Murray McLean, our CIO, reports strong US equity returns of 5% in Q2 2024, driven by tech and AI optimism. Despite a 0.5% dip in Canadian equities, the Bank of Canada cut interest rates by 25 Bps, leading the G7. Our portfolios now shift from US to International equities. Watch our video for full insights.

Market Commentary – April 2024

In early 2024, optimism for interest rate cuts faded as central banks tempered expectations due to persistent inflation around 3%. This has delayed rate reductions, expected later this year, which may be less aggressive. Watch our video for a detailed overview and valuable insights.

Market Commentary – January 2024

In 2023, the investment landscape showed positive trends. For a deeper insight into the market dynamics, our Chief Investment Officer and Portfolio Manager, Murray McLean, provides expert commentary. Watch the informative video below for a comprehensive overview and valuable advice.