Winter 2022 Market

Commentary

Ryan Sheriff

The markets are off to a challenging start in 2022. There are a few key points to keep in mind amidst the volatility.

You have insurance

Your Open Access investment strategy is designed for uncertain times. While volatility in “the market” is capturing headlines, your savings are not entirely exposed to stock market declines. Your Portfolio allocates across a range of strategies, with some providing growth and others hedging risks. So far in 2022, the hedges in your account are providing some stability. Diversification is working.

Your investment team is on top of it

Open Access monitors your Portfolio everyday to ensure it is properly positioned. As noted in our latest market commentary below, we believe that the markets can continue to climb in 2022. That said, a pick up in volatility this year was expected. Our team anticipates adjusting your mix of growth and market hedges more frequently throughout the year. Greater churn across markets has risks, but also opportunities.

We’ve been here before

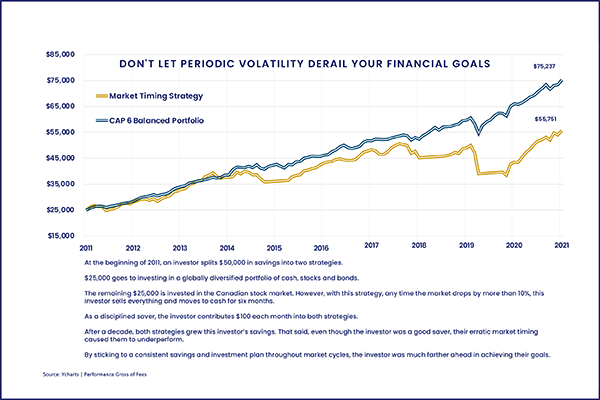

Markets are currently undergoing a transition from growth driven by stimulus to growth reliant on fundamentals. Historically – think 2013, 2015 and 2018 – this transition hasn’t been smooth. As the market cycle adapts, however, temporary declines proved to be buying opportunities. Over the last decade through 2021, the Canadian stock market more than doubled your investment. The critical point is that these gains only accrued to investors that were not shaken out during volatile periods.

There is a gameplan for navigating these markets

We remind clients that market timing is challenging because it requires you to be right twice. You need to know when to sell, but also when to get back in. For example, over the last ten years, there were a number of times when the stock market corrected by more than 10%. During these periods, it seems intuitive to move to the sidelines until the environment turns more favourable. The caveat, however, is that the greatest gains typically occur early in the recovery when things are still unsettled. Missing out on these gains can undo all the efforts to avoid losses. Sticking with a diversified investment strategy through the ebbs and flows puts you further ahead in achieving your financial goals.