Save on Fees – At What Cost

Ryan Sheriff

Today, a subset of people are moving away from working with financial professionals and opting for the do-it-yourself (DIY) investing approach. The appeal is straightforward.

Ditch your advisor, save on fees. Fees, according to discount brokers, are the main problem holding investors back. Yes and no. Open Access agrees that the fees charged by some financial institutions are extreme and doing a disservice to clients in reaching their financial goals. That said, a stack of research studies, along with our experience, suggests that most people benefit from the assistance of a portfolio manager. Even after fees, the net results of an investor receiving professional guidance is likely to be higher than the do-it-yourself trader. It is less about detailed market research and up-to-the-minute news tickers – today’s savvy DIY investors have access to information just like the pros. It comes down to psychology. We tend to be our own worst enemy when it comes to managing money. In a typical company retirement plan, employees pick from a laundry list of investment options. As a leading provider of pension plans, Open Access has seen firsthand how this type of DIY investing can lead people astray.

The Woeful Track Record From Market Mistiming

At the forefront of the DIY push in recent years have been mobile trading apps that make it easy to buy and sell stocks, exchange-traded funds, and cryptocurrencies from your phone. Making finance accessible for everyone is laudable. On closer inspection, however, an oversimplification of investing causes most of their users to be less successful in attaining their financial goals.

A study conducted in late 2020 found that the stocks that trade app users flocked to reliably lost money in subsequent months. This trend was so reliable, in fact, that professional investors built profitable strategies based on taking the other side of these losing trades. As is the case with many forms of speculation, the house always seems to win. Outcomes like this support Morningstar’s annual Mind the Gap research. The “gap”, in this case, is the difference between a mutual fund’s return, and the return of the average investor in that fund. Had the typical saver simply adopted a “buy and hold” strategy, their return would equal the fund’s return and there would be no gap. Year-after-year, however, Morningstar finds that the average investor consistently underperforms because of mistiming their buying and selling of mutual funds. Ultimately, these results come down to the fact that with a broad assortment of funds, styles, or individual stocks to choose from, most people simplify their selection process by choosing investments that did well recently, while selling those that have performed poorly. While sensible at first glance, this approach results in buying high and selling low.

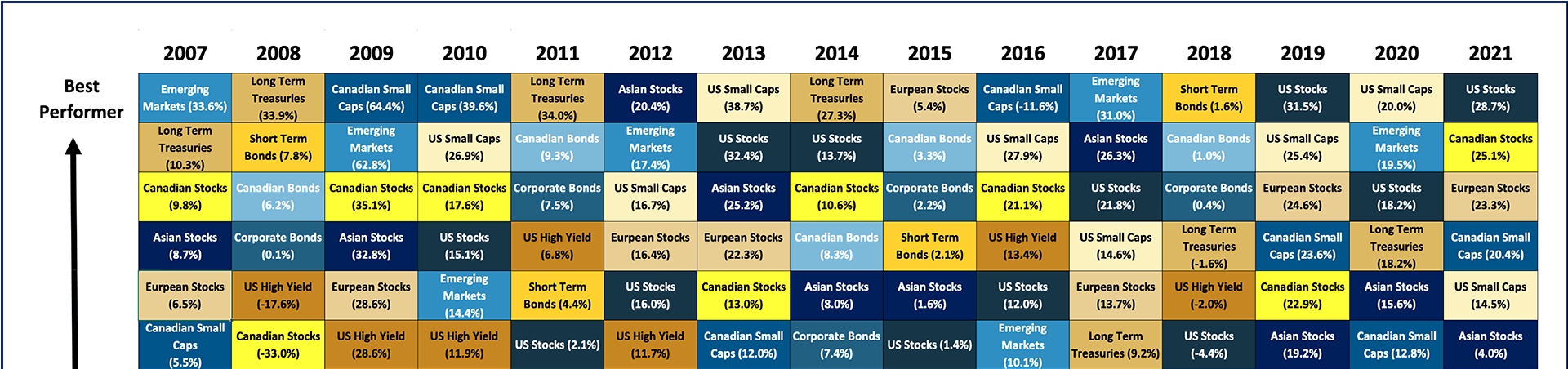

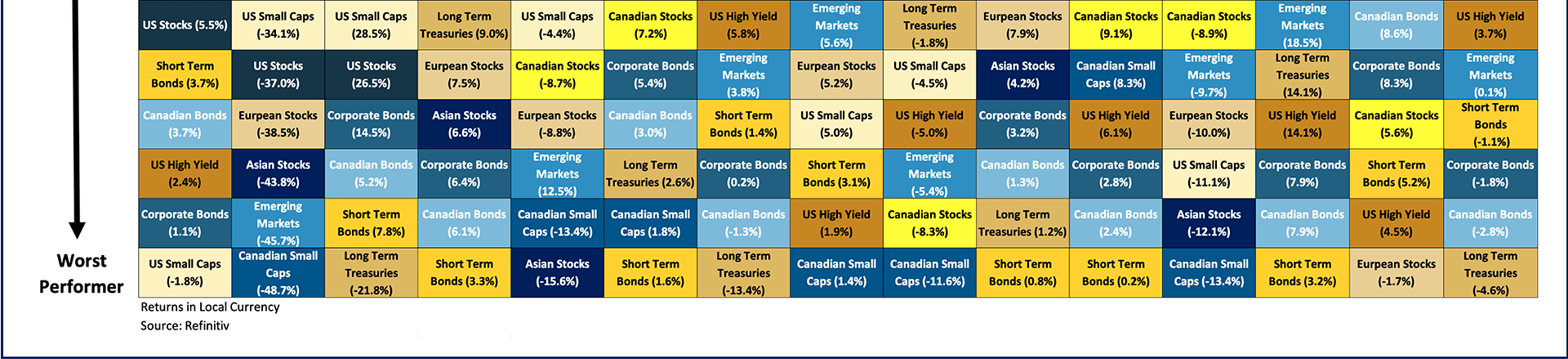

Avoid Chasing Past Performance

In the graph above, we show the year-to-year changes across twelve global asset classes. To illustrate how market mistiming leads to disappointing outcomes, we compare the difference in performance between two strategies over a 15-year period. The first strategy is naive diversification – an investor allocates an equal amount across all twelve markets. The second approach resembles the trading pattern of a DIY investor. At the beginning of each year, they chase performance by selling what they own and investing in the previous year’s winning asset class. After 15-years, the diversified investor compounded their savings at 6.7% on average each year. They were much farther ahead in achieving their financial goals, with their initial contribution more than doubling.

For all the efforts to “actively manage” their account, the DIY investor achieved a mere 0.7%. To be fair, the trading pattern of this hypothetical DIY approach may be exaggerated. On the other hand, the available investment options in our example was limited to just twelve asset classes. We believe the gap between a sensible approach and a market mistiming strategy widens as the number of investment options increases. Even the savviest of DIY investors could use the help of a portfolio manager. In nearly every case, the best approach to achieving financial goals comes down to three principles. By building a globally diversified portfolio, staying the course through the ebbs and flows of the markets, and rebalancing as needed to reflect a client’s unique circumstances, the value of a good financial professional significantly offsets their fees.