From FOMO to VUCA, and What an Investor Should Do About It

Ryan Sheriff

What a difference of few months can make. It is not that long ago that we were shaking off the last remnants of winter.

Today, the days are longer, the sleeves are shorter, and minds are naturally drifting to the lakes, cottages and patios that mark the coming summer season.

The market cycle is certainly shifting as well. The consensus view in prior months was that inflation was a temporary nuisance. Economic growth would fall into a goldilocks not-too-hot, not-too-cold equilibrium. In prior quarters, the top economic experts believed that higher interest rates were at least a few years out.

Here we are. To paraphrase the English historian Arnold Toynbee, investors have been hit with “one damn thing after another” in 2022. Inflation at a multi-decade high due to snarled supply chains and the outbreak of war. The world’s second largest economy still grappling with COVID-19 lockdowns. And, higher interest rates decisively hitting the breaks on economic growth.

Gone are the days of FOMO, where the “fear of missing out” on cryptocurrencies and meme stocks dominated investor attention. Today, the common acronym expressed throughout boardrooms and conference calls is VUCA. That is, an environment characterized by “volatility, uncertainty, complexity and ambiguity”.

It is unpleasant to see a negative sign attached to your investment performance, even in the short-run. What’s more, VUCA, by definition, means that is it difficult to determine exactly when negative returns start to recover. Amidst darkening headlines, it is intuitive to consider moving your investments to cash and waiting out the storm.

We advocate for a different approach. Specifically, we continue to recommend the diversified investment strategies that worked well when times were more fortuitous. It is not because there is something in it for us, or that we prefer to do nothing during challenging periods. In fact, over the last few months, the investment team at Open Access actively managed client accounts to dampen volatility as much as possible.

Our advice is rooted in the fact that by avoiding knee-jerk reactions to market movements, you ultimately end up wealthier.

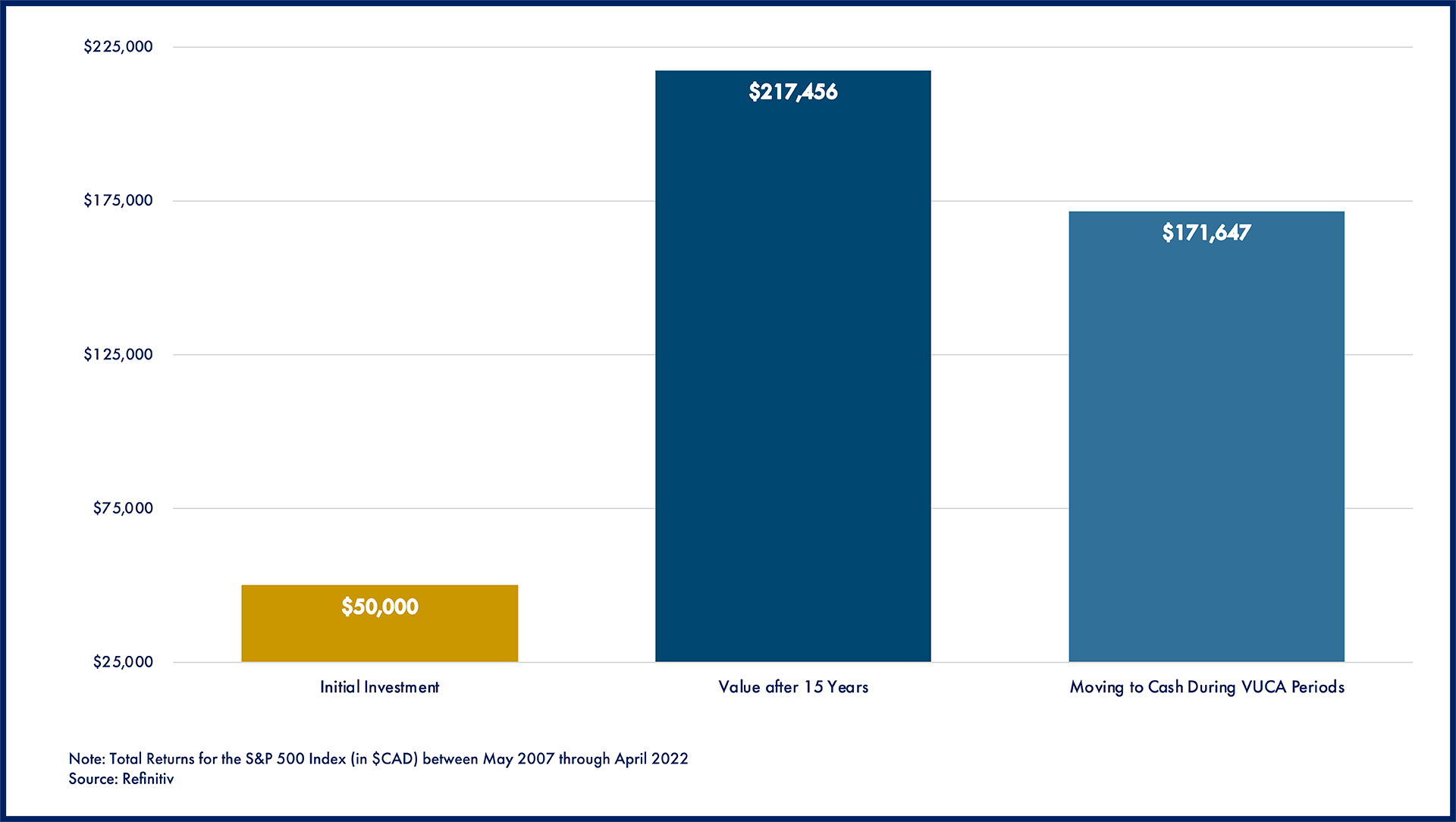

Over the last fifteen years, the stock market returned, on average, more than 10% per year. For context, the graph below shows these gains were enough to grow an initial investment of $50,000 to more than $217,000.

Zooming in on the day-to-day history of the last fifteen years, however, it is remarkable how choppy the markets appeared to be at any given time. From a global financial crunch, to pending credit defaults, recessions and a pandemic, it was “one damn thing after another”.

Our team went back and looked at the worst fifteen days in the markets over this time frame. It was ugly, as anyone recalling the -8% to -12% drops during the pandemic crash of 2020 can attest. We asked ourselves what would have occurred had someone sold their investments the day after these historic drops and waited out in cash for three months.

It turned out that, in some sense, this was a good move. Outsized declines tended to foreshadow further declines. However, over the same fifteen year time frame, an investor was worse off as a result of market timing. Specifically, they achieved a lower return, which led them to being $45,000 farther away from achieving their financial goals.

What is at play here? The tables below show that volatility works both ways. While sizable daily declines tended to cluster together, they also coincided with some of the best days in the market shortly after. The market tends to be the darkest before the dawn. In terms of building wealth, history shows that it is better to embrace the silver linings of VUCA periods, rather than waiting for better seasons to get back into the markets.

The team at Open Access wishes you and your family a wonderful summer ahead.

The Market Dropped -8.75%

on September 29th, 2008

By Moving to Cash, You Avoided:

October 7th 2008

-6.06%

October 9th 2008

-5.62%

October 15th, 2008

-6.76%

October 29th, 2008

-5.96%

By Moving to Cash, You Also Missed:

September 30th, 2008

8.23%

October 13th, 2008

8.74%

October 16th, 2008

5.36%

October 20th, 2008

5.81%

October 28th, 2008

10.89%

The Market Dropped -6.91%

on March 9th, 2020

By Moving to Cash, You Avoided:

March 12th, 2020

8.68%

March 16th, 2020

-12.06%

March 20th, 2020

-5.05%

By Moving to Cash, You Also Missed:

March 10th, 2020

6.85%

March 13th, 2020

10.24%

March 17th, 2020

7.62%

March 24th, 2020

8.95%

April 6th, 2020

7.34%

S&P 500 ($CAD) Total Returns

Source: Refinitiv