The Search for Professional Investment Management Services

Warren Laing

Quietly, behind the scenes corporate Canada is capping their defined benefit pension plans (“DB”), and diverting their plan members and future contributions to defined contribution (“DC”) retirement plans, to avoid the costly liability of guaranteed employee pensions.

Under this new arrangement employees no longer benefit from the professional discretionary investment management services provided by the DB plan. These are the investment managers retained by the plan sponsor to manage the portfolio of securities held in a DB pension plan on a discretionary basis within the terms of the Statement of Investment Policies and Procedures designed by the corporate sponsor. These managers act as a fiduciary making all investment decisions based solely on the best interests of the pension plan and in return are paid a fee by the plan sponsor.

This article deals with, how does a plan member replace professional investment management services? What are the options, and how have these options changed over the years?

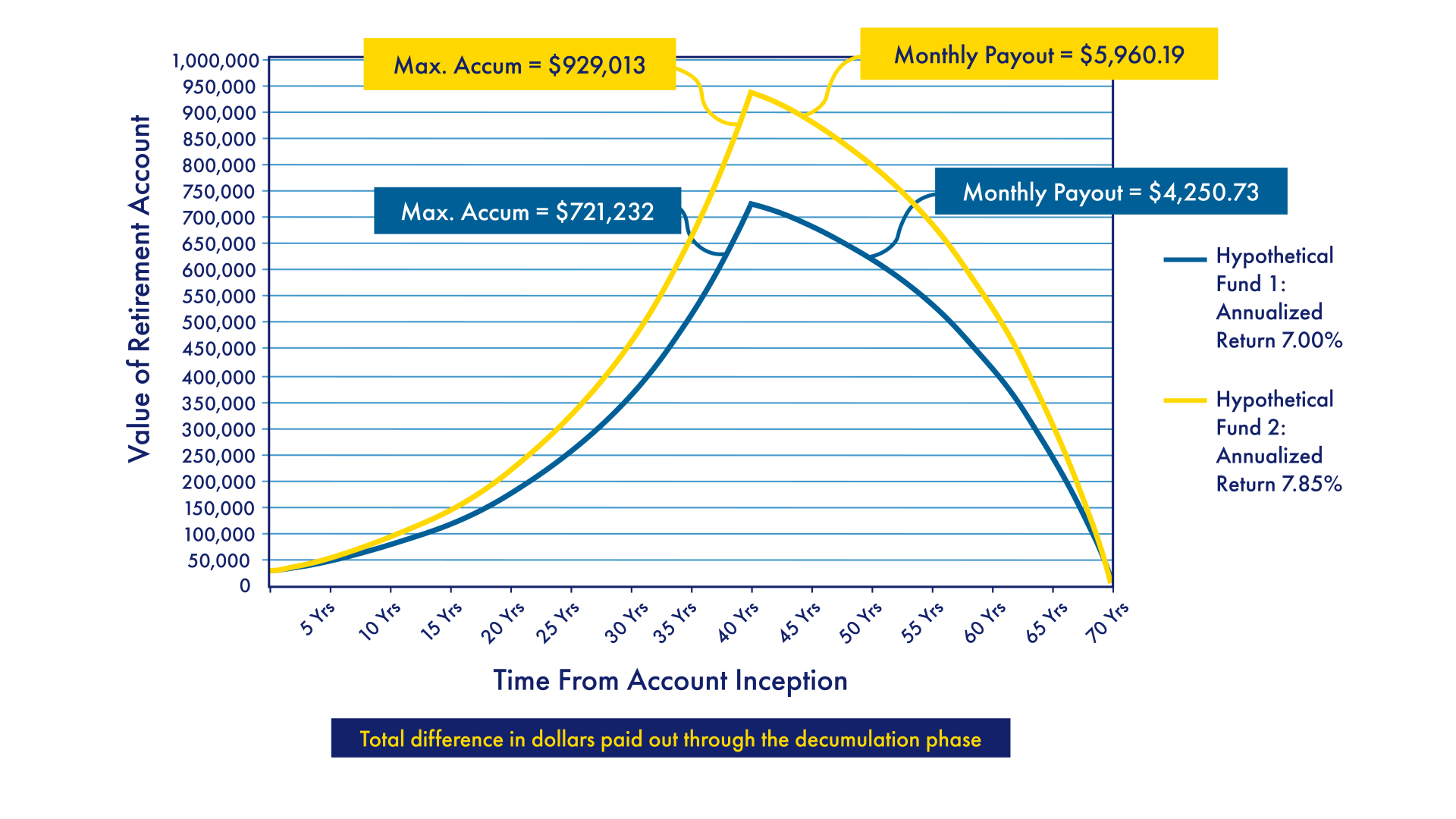

Impact of Difference in Returns on Monthly Payout at Retirement

This chart demonstrates the cumulative impact of a modest difference in returns on a portfolio. The lines shown represent the asset values of two funds, one with gross annualized returns of 7.00% and the other 7.85%. Both funds are assumed to be paying annual fees of 1.00%. Each fund begins with a balance of $25,000 and includes annual contributions of $3,000 for 40 years; thereafter, contributions cease, and retirement income is withdrawn from each fund at a monthly level that exhausts the balance over the next 30 years.

When this trend towards DC retirement plans started to build momentum the investment options available to plan members was limited, usually just a list of insurance company segregated investment funds from which the plan member selected how their cash flow was to be invested. Later, the industry added third party mutual funds cloaked in a segregated fund wrapper. This however still didn’t solve the challenge facing plan members, since most members have little experience managing investment portfolios or understanding investment risk, and they wanted assistance.*

As a result, the insurance industry introduced Target Date Funds (“TDF”), a wrapper fund consisting of common stock and bond funds that included a “glide path” during which time the commitment to common stocks would be gradually lowered to reduce the variability of the fund as a plan member aged. The theory was that the plan member would select the TDF with a maturity date that matched the retirement year of the plan member. The weakness of this arrangement is not all employees who are the same age have the same ability to accept investment risk. For instance, a 45-year-old chief financial officer presumably can accept more investment risk than a 45-year-old maintenance worker. Secondly, the financial institutions offering TDFs are often conflicted by the decision on which common stock fund to include in the TDF, their own or a third party fund with an excellent track record. These wrapper funds also tend to be expensive.

Recently, with the increasing popularity of index funds, some financial institutions are now offering plan member’s portfolios of exchange traded index funds (“ETF”) either within a TDF wrapper or on their own. The benefit of ETFs are the low fees, however the plan member is still left having to make investment decisions such as; the mix between bonds and common stocks, when to change the asset mix, selecting a bond ETF with the appropriate term to maturity, and the geographic distribution of the common stock portfolio.

Unfortunately, neither of these options provides a complete solution to the plan member’s dilemma, namely who is going to make the above investment decisions, and thereby relieve the plan member from the responsibility of making investment decisions that they are ill-equipped to make. This is especially important when one considers that their financial well-being during retirement, depends on the quality of the investment management services they receive.

There is another option, and that is for the retirement plan to retain a professional investment manager to provide discretionary investment management services to the plan members on an individual basis. This is the same process used by the investment manager for the DB pension plan; except now it is done on an individual basis. In this model the investment manager has the authority to make changes in the composition of the portfolio as required, this is called discretionary authority, however to do so successfully the manager needs a greater understanding of the plan member’s individual circumstances, which is obtained through a more detailed questionnaire completed by the plan member. Since the investment manager also acts as a fiduciary, in other words acts solely in the best interests of the plan member, as he is not receiving commissions or fees from any other party, nor is he attempting to sell additional products or services to plan members, one can rely on the investment manager to protect the plan member’s interests.

In our opinion, this is the most attractive option available, for the following reasons:

- The investment advice is based on more than just the plan members’ age.

- It is ongoing advice that may result in asset mix shifts or changes in the geographic distribution of the common stock portfolio, when the manager believes it is appropriate to do so.

- It is unbiased advice free from conflicts of interest.

- Assuming proper due diligence has resulted in the selection of a competent investment manager; the investment results will likely be superior.