Winter 2022 Market Commentary

Ryan Sheriff

2021 Investment Year In Review Looking Back, Looking Forward, and Something About Flywheels.

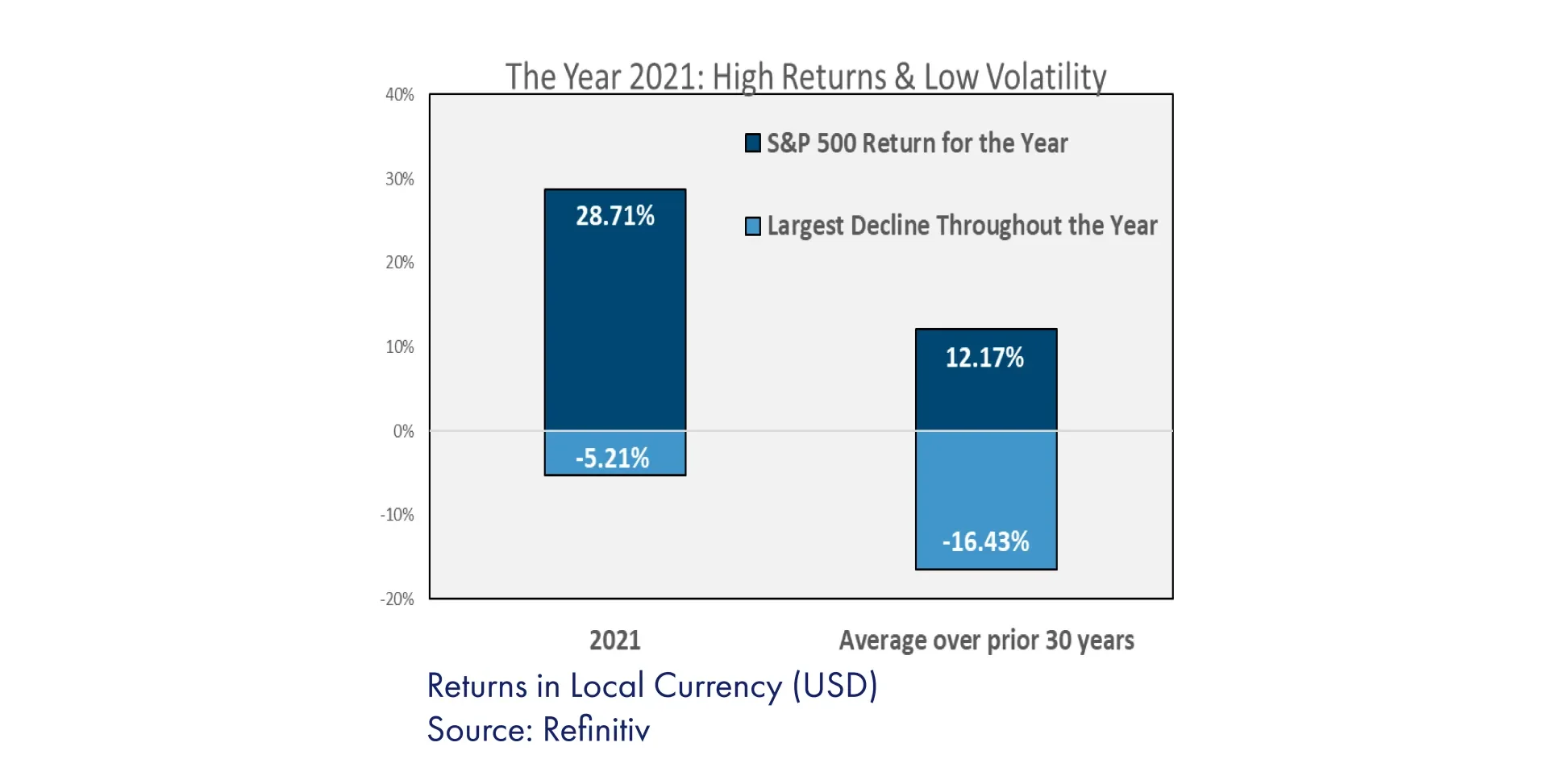

North American stock markets rallied quarter after quarter in 2021, on their way to notching another year of double-digit advances. What’s more, though there were some momentary scares along the way, volatility was kept in check.

The Open Access Portfolios performed well over the year. We are pleased to see that clients are closer to achieving their financial goals as a result. That said, our job as a wealth manager is as much about mitigating risk as it is about achieving high returns.

To say that volatility remained low last year masks the fact that investments climbed a wall of worry in 2021. The market remained resilient through the emergence of new COVID variants, heavy-handed crackdowns by Chinese authorities on technology and real estate firms, and some of the highest inflation readings in decades.

Although at a high level equity market performance looked good throughout the year, our team noted something unusual occurring below the surface.

From April 2021 through yearend, more than half of the S&P 500’s performance was attributable to just five stocks. As the broad market notched all-time highs in December, hundreds of smaller stocks within the index were hitting their low points for the year.

Narrowing rallies can portend danger ahead for investors. For example, deteriorating market breadth famously characterized thedot-com bubble two decades ago.

Fortunately, our investment team believes that last year’s parallels to previous bubbles remains tenuous. There are pockets of speculation in the market today – think meme stocks, “new era” technology companies and cryptocurrencies. Fortunately, the healthy unwinding of these pockets of excess are not leading to widescale damage for investors. The reason why – and the key differentiator between the dot-com bubble and today – is profitability.

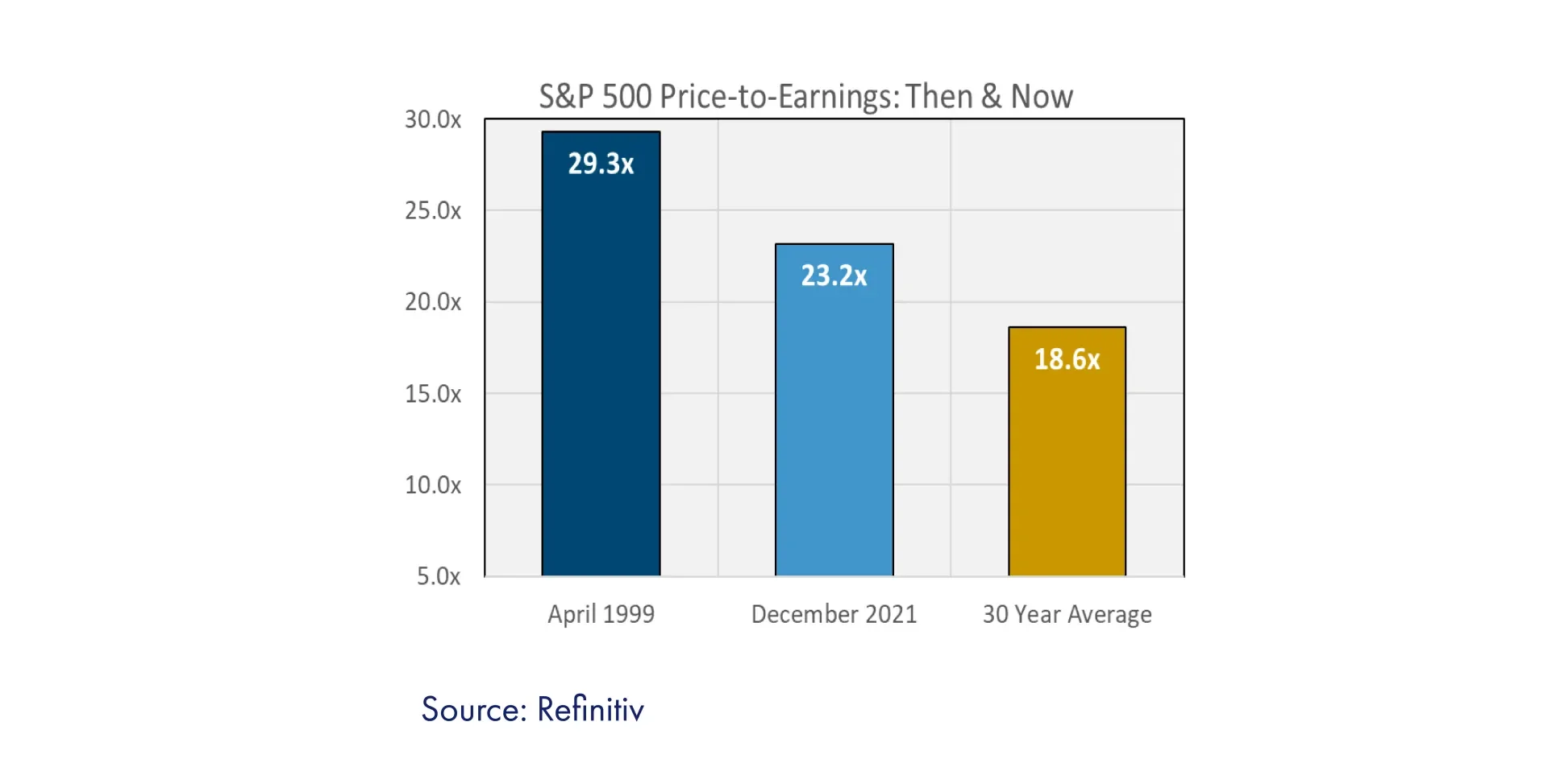

In the early 2000’s, the rally was largely driven by excessive optimism. Higher stock prices were the result of investors paying more for the same level of company earnings.

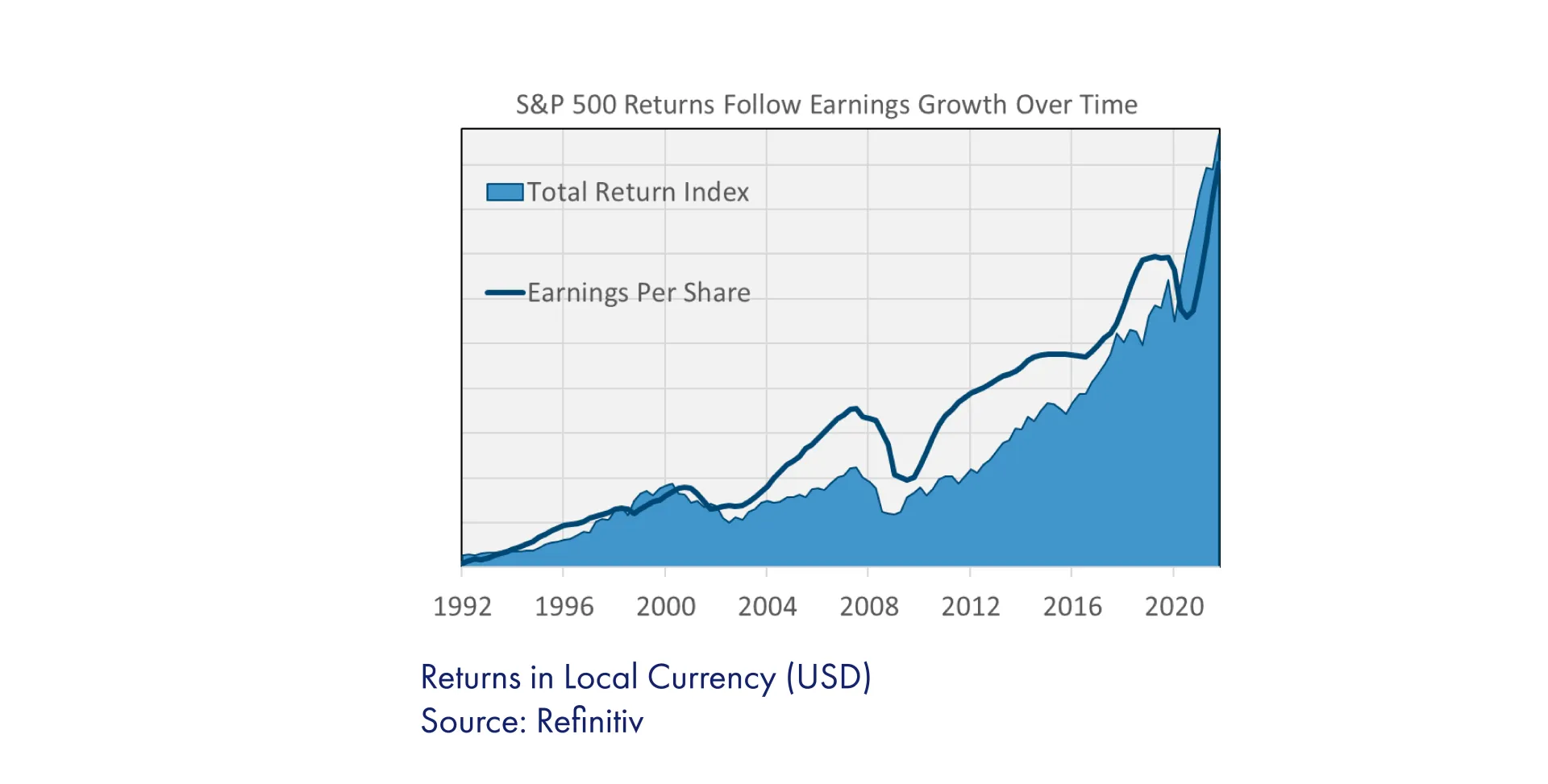

In contrast, given the risks present below the surface, sentiment remained subdued last year. Stocks did not rise because investors paid more for earnings in 2021. The markets hit all-time highs because earnings and profit growth also hit all-time highs.

To be sure, we do not see a repeat performance for equities this year. Another central underpinning for the markets over the last few years – waves of stimulus running through the system – is receding. And, while valuations are not egregious, they are still elevated from historical averages. These factors dampen growth potential and increase the risk of market corrections going forward.

With that in mind, downside risks for equities will probably be stemmed prior to entering bear market territory (a term for declines of more than 20%). Similar to 2021, short-term market weakness this year is likely to be a buying opportunity.

Ultimately, economic expansion drives earnings growth, which in turn drives market gains. With few indications of recession in the cards, equities should continue to climb the wall of worry in 2022.

Good to Great

The fact that a handful of companies accounted for the bulk of market gains this past year brings to mind the book “Good to Great” by Jim Collins.

The Flywheel is a central concept. It is the idea that in each of these exemplary companies, long-term success was not due to a single breakthrough or “Eureka” moment. Rather, Collins describes the common strategy of these companies as pushing on a giant,

5000-pound metal Flywheel again and again.

Over the course of years, these persistent nudges slowly moved this Flywheel in a certain direction. Eventually the disk picked up speed and rotated solely based on its own momentum.

The Flywheel concept guides our team’s beliefs in building client wealth. No singular effort to get rich quick is going to reliably make the difference. From past to present, we see what can occur when speculation starts to unwind.

Rather, a consistent process for capturing market opportunities and managing emerging risks leads to long-term investment success for our clients.

After the last year, we are pleased with the momentum building in our Portfolios’ Flywheels. Here is to further gains in the years ahead.