TFSA or RRSP?

Aoife O’Reilly

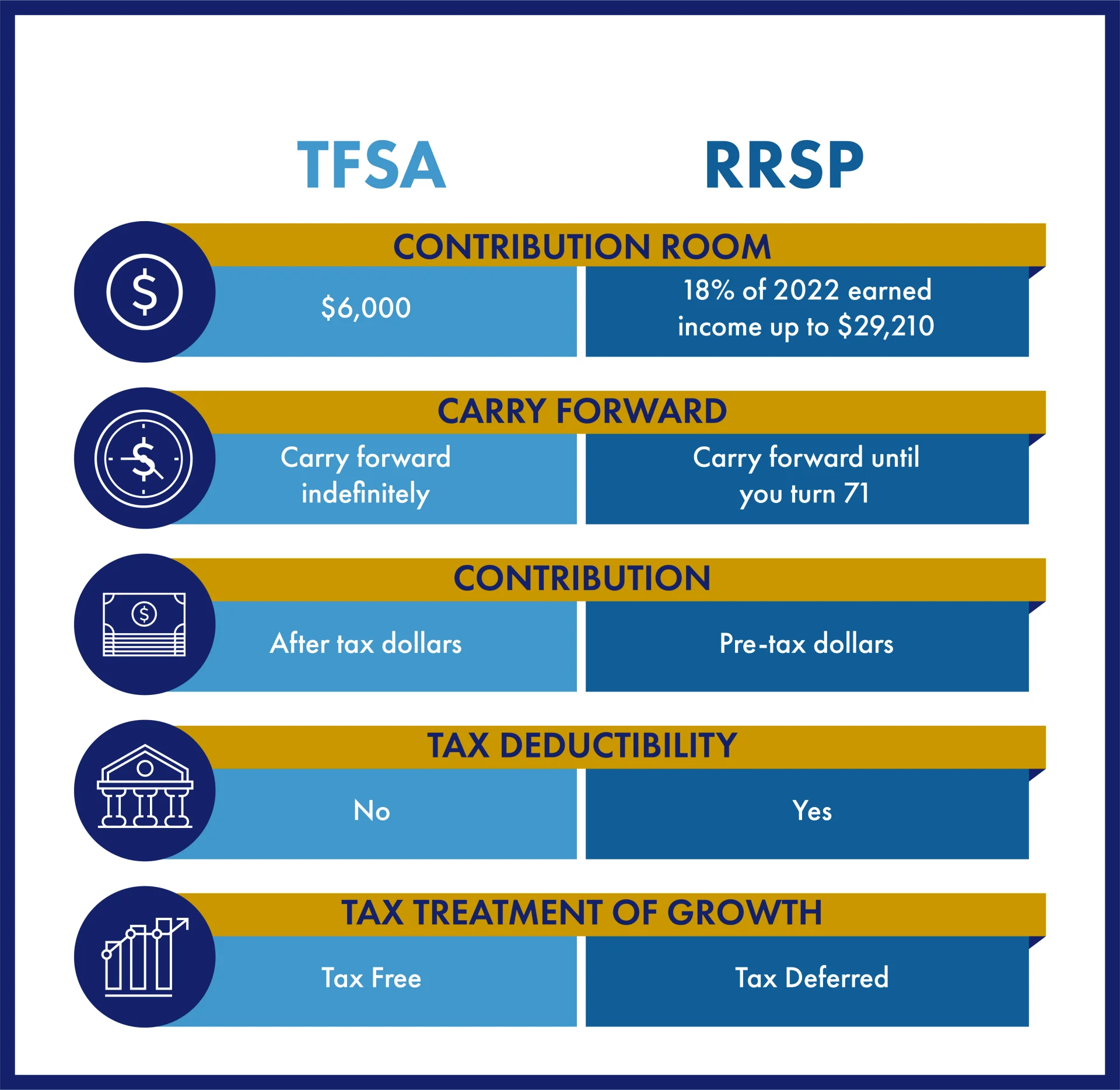

There are considerable benefits to getting a Tax Free Savings Account (TFSA) and a Registered Retirement Savings Plan (RRSP) but do you need both?

This article highlights what a TFSA and RRSP have to offer and the advantages that they can bring.

The first question to ask yourself, before opening one of these accounts, is to decide what your objective is. Are you looking to save for a short term purchase such as a vacation, vehicle or home renovation? If your goal is to save for something short-term, a TFSA is ideal for you.

TFSAs are available for all Canadians over the age of 18. Contributions to your TFSA are made after tax, and investments grow tax-free. It’s worth noting that there are no tax implications for withdrawals and it’s quick and easy to access funds. Many people use TFSAs to save for a rainy day and invest their savings in a tax-efficient way.

RRSPs, on the other hand, are better for a long-term financial goal such as saving for retirement. They are tax-deductible accounts, meaning that the amount you contribute is deducted when you file your income tax return. One significant advantage of a RRSP is that you can contribute using pre-tax dollars but only pay tax on withdrawals made during retirement years. Typically, your earnings decrease during retirement so you’re in a lower tax bracket. In addition, if you are earning a high salary a RRSP helps decrease your marginal tax rate.

Many employers today offer a matching contribution, on a percentage of your salary, for employees in a group RRSP, so this is a fantastic way of increasing your retirement savings. If you are not currently set up on a group RRSP, you may wish to reach out to your HR department to find out if this is possible for your organization to set up. Open Access provide group retirement plans for companies across Canada and we’ve been helping small to medium sized businesses reach their goals for over 25 years.